In the previous post, I've justified a range of 13-15 billion pounds of paper towels used in 2012. Smith's talk aimed at making people conscious of proper paper towel usage, which should make one towel sufficient for the purposes of drying hands. More than one would be waste. Joe Smith's TED talk claims that using one less towel per day per person will save over 571,230,000 pounds of paper per year. That was in March 2012.

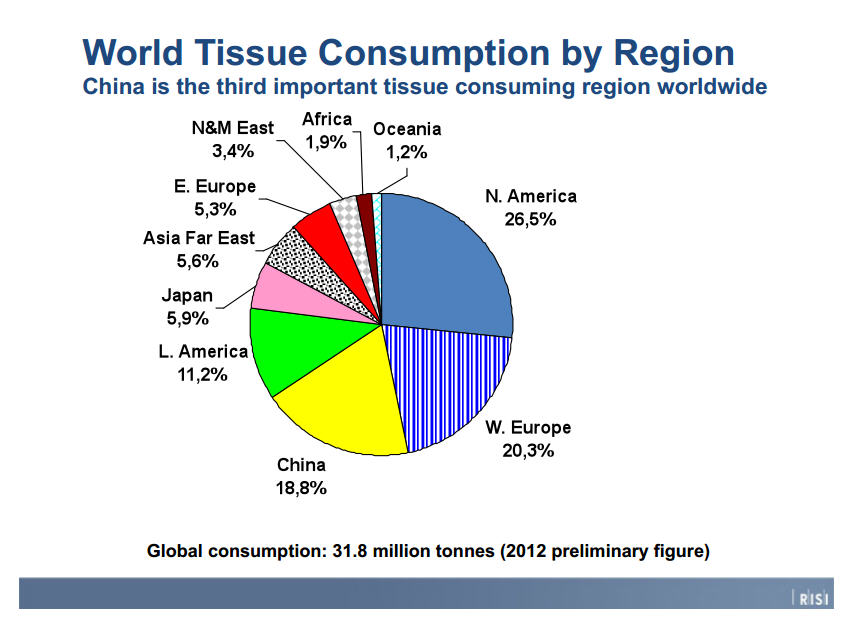

The population in March 2012 was 313,152,958. One paper towel for each person in the U.S. each day for a year is 114,300,829,670 towels. That implies a weight per towel used by Smith of 0.005 pounds, or about 2 grams (2 paperclips). RISI estimates that 2/3 of tissue consumption is at home while 1/3 is in commercial use. I assume overuse is most prominent in the commercial context. 1/3 of the 13-15 billion pounds is 4.3-5 billion pounds of paper towels used commercially.

I'd think that the amount of towels pulled from a dispenser is something like a log-normal distribution in a commercial context. In my experience, I don't often see a person use one paper towel or one napkin at the table and so I'd put the peak at 2 per use. I'll split the probabilities arbitrarily, on my own guess, up like this:

20% - 1 towel

45% - 2 towels

30% - 3 towels

10% - 4 towels

5% - 5 towels

That would put around a billion pounds of commercial paper towels (or 200 billion individual towels) as used properly, and the remaining 3.3-4 billion pounds (or 660-800 billion individual towels) as waste. Saving one towel per day per person such as Smith did is a wise thing to estimate because it deals in mostly concrete values and not on your own idiotic and unfounded estimates, but detailing the context to orders of magnitude starts to illuminate the waste of what can be saved.