The unknowns in this valuation are how much mol is produced, how much it can be sold for and how much it costs to dig up. The price forecast is my solution to how much it can be sold for. Production estimates and cash costs are taken from TC estimates in SEC filings, but these numbers can be incorrect. Given that TC produces ~30 mlbs of mol a year, a $1 plb squeeze of estimated and real cash costs can drop (or add to) revenues by +/- $30M dollars. Margins decline and the mol business can quickly break-even or negative as CC plb changes. Estimated CC's in 2012 were $7.75-9.00 in the 2011 annual report, while the realized CC was $10 plb for 22 Mlbs of mol.

Since I have no understanding of TC's vulnerability to cash cost increases, I'll run the high end CC's estimated for 2013+2014 to compliment the low-end forecasts given in the last post, and then I'll run one more outside of the range at $9 plb as an exceptionally bad case.

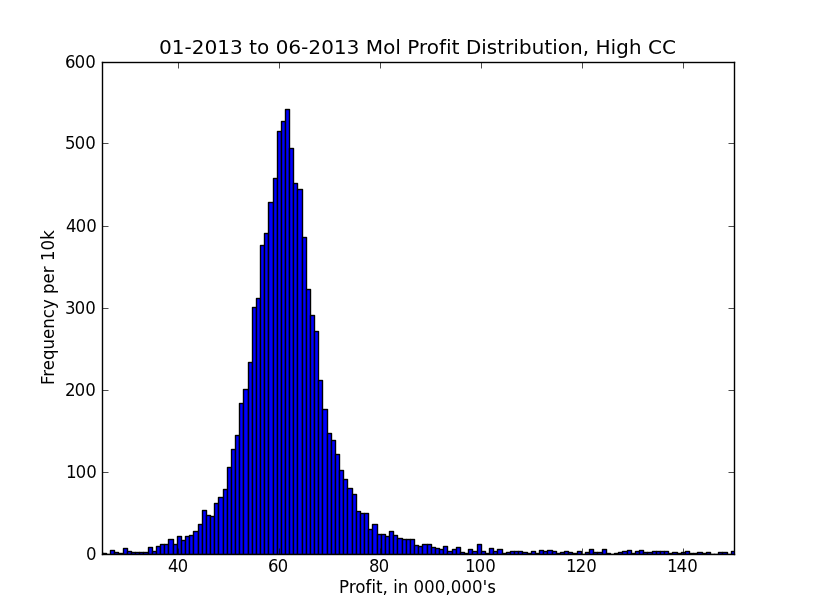

For CC's of $7.50 in 2013 and $7.75 in 2014 (estimates provided by TC):

For $9 plb:

This indicates that it should be a successful year for the mol business in TC. Unfortunately, TC's business is moving away from mol as plans exist to shut down the TC mine in 2015. Those efforts will go into Mt. Mulligan, a gold and copper producer. This will eliminate TC as a pure play producer and consequently, the best way gamble directly on mol prices. That said, TC's valuation has languished on the poor performance of the mol business. The pricing might not be right on that. Fortunately, I don't have money enough to care either way.

No comments:

Post a Comment